Understanding compulsory SOCSO coverage for employers of domestic helpers (maids) in Malaysia

Published on 13 Dec 2023, last updated on 7 Mar 2024

Table of contents

Introduction to SOCSO Coverage

The Social Security Organisation (SOCSO, also known as PERKESO) announced the extension of social security protection coverage to domestic workers effective 1 June 2021. If you are a Malaysian employer of a foreign domestic helper (maid), this new government rule needs to be complied with. If you are a foreign expatriate employer hiring a foreign domestic helper (maid), this new ruling does not apply to you.

SOCSO Benefits for Maids and Domestic Workers

1. Foreign domestic workers are covered under the ‘Employment Injury Scheme’ of Act 4, where they are able to claim, due to workplace accidents, the following benefits:

- Medical benefit

- Temporary disability benefit

- Permanent disability benefit

- Dependent benefit

- Permanent service allowance

- Physical/Vocation/Return to Work/Dialysis benefits

- Corpse management benefits, in the event of death

2. Under this scheme, employers are mandated to contribute 1.25% of their workers’ monthly salaries, including overtime pay to SOCSO. Workers are exempted from contributing, and payments can be made via SOCSO’s online Employer ASSIST Portal after registration.

3. Employers of foreign domestic workers with existing private insurance coverage are not exempted from this ruling. Starting 31 May 2022, all employers must register and contribute through SOCSO by 1 June 2022 even if their worker's existing policy only expires after 31 May 2022.

SOCSO Registration is now Mandatory for Malaysian Employers of Filipino Domestic Helpers

Starting January 2022, Malaysian employers of Filipino domestic helpers are required to register and contribute to SOCSO as the Philippine Migrant Worker Office in Kuala Lumpur (MWO-KL) has released an advisory making it mandatory for all Malaysian employers to present SOCSO registration and contribution proof for any POEA contract verifications/ renewal transactions from 2 January 2022 onwards (Source: MWO-KL, formerly known as POLO).

Detailed Guide to the SOCSO Registration Process for Employers of Domestic Helpers (Maids)

Part 1 - Preparing for SOCSO Registration

Refer to the visual flowchart below to familiarise yourself with the SOCSO registration process. Please note that the process of registration may take up to between 3 to 5 working days based on our experience.

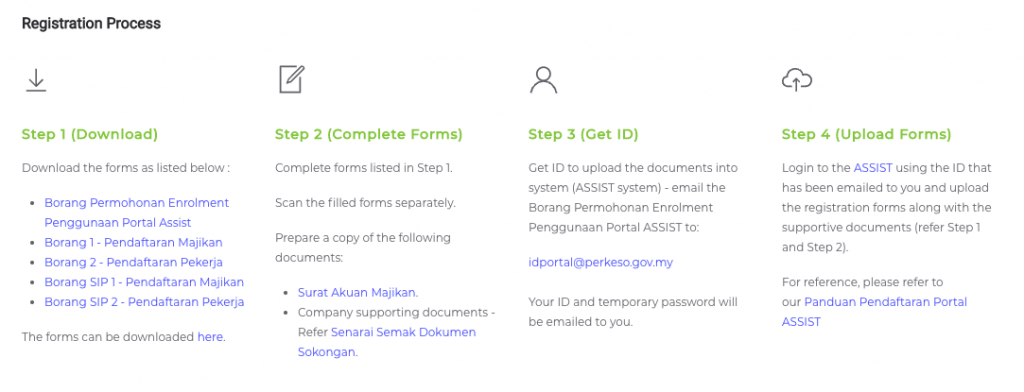

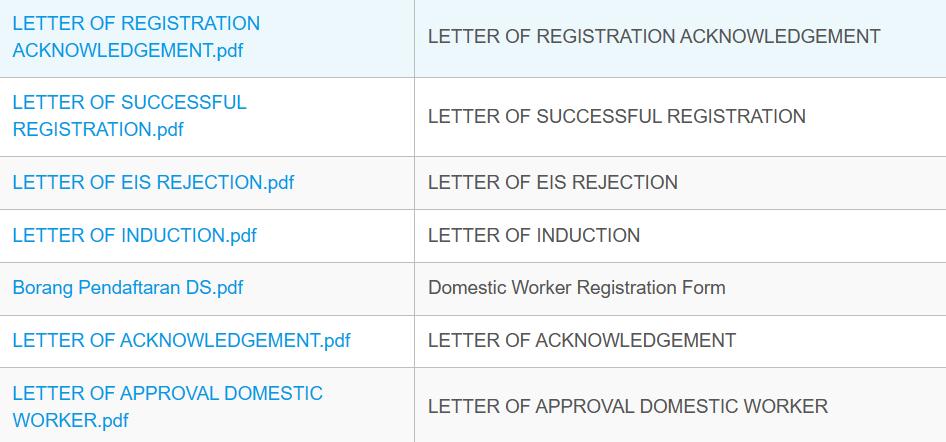

View this screenshot from the SOCSO guideline page (Source: SOCSO) - the form names shown below differ slightly from the actual form names of the files as SOCSO's page is not regularly updated:

Before starting, prepare scanned copies of the following supporting documents for verification:

- Employer’s IC or Passport

- Worker’s Latest Passport

- Worker’s Latest Work Permit (optional)

Part 2 - Fill in the required SOCSO Forms

You will be asked to fill in 4 SOCSO forms at different stages of the SOCSO registration process:

- Borang Pendaftaran ID Portal PERKESO / Portal ID Registration Form (download)

- Borang Pendaftaran Majikan (Borang 1) / Employer Registration Form (download)

- Borang Pendaftaran Pekerja Domestik (Lampiran C) / Domestic Worker’s Registration Form (download)

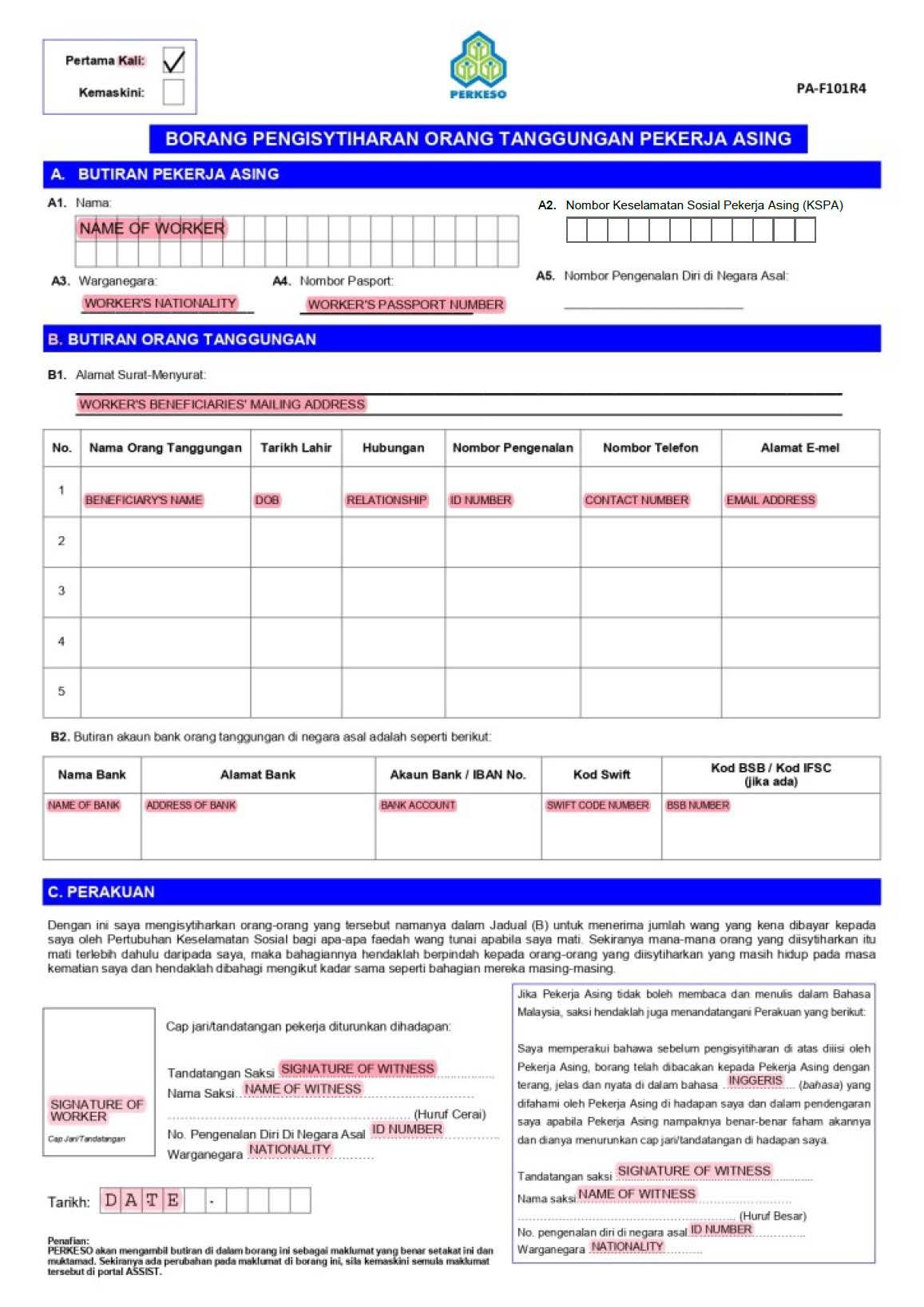

- Borang Pengisytiharan Orang Tanggungan Pekerja Asing / Domestic Worker’s Beneficiaries Form (download)

Pinkcollar's sample forms will guide you in filling in all the required forms accurately.

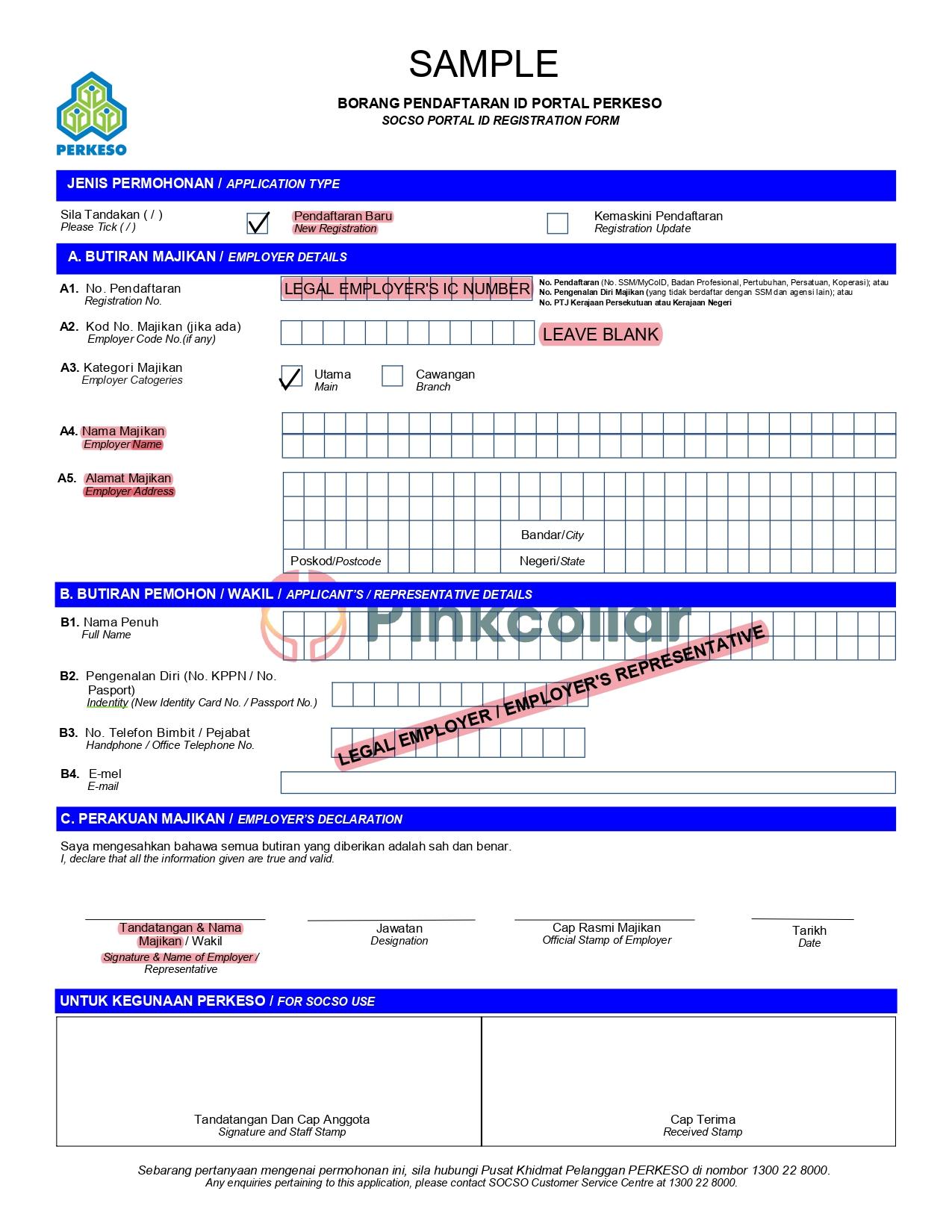

Sample 1: Borang Pendaftaran ID Portal PERKESO / Portal ID Registration Form (download)

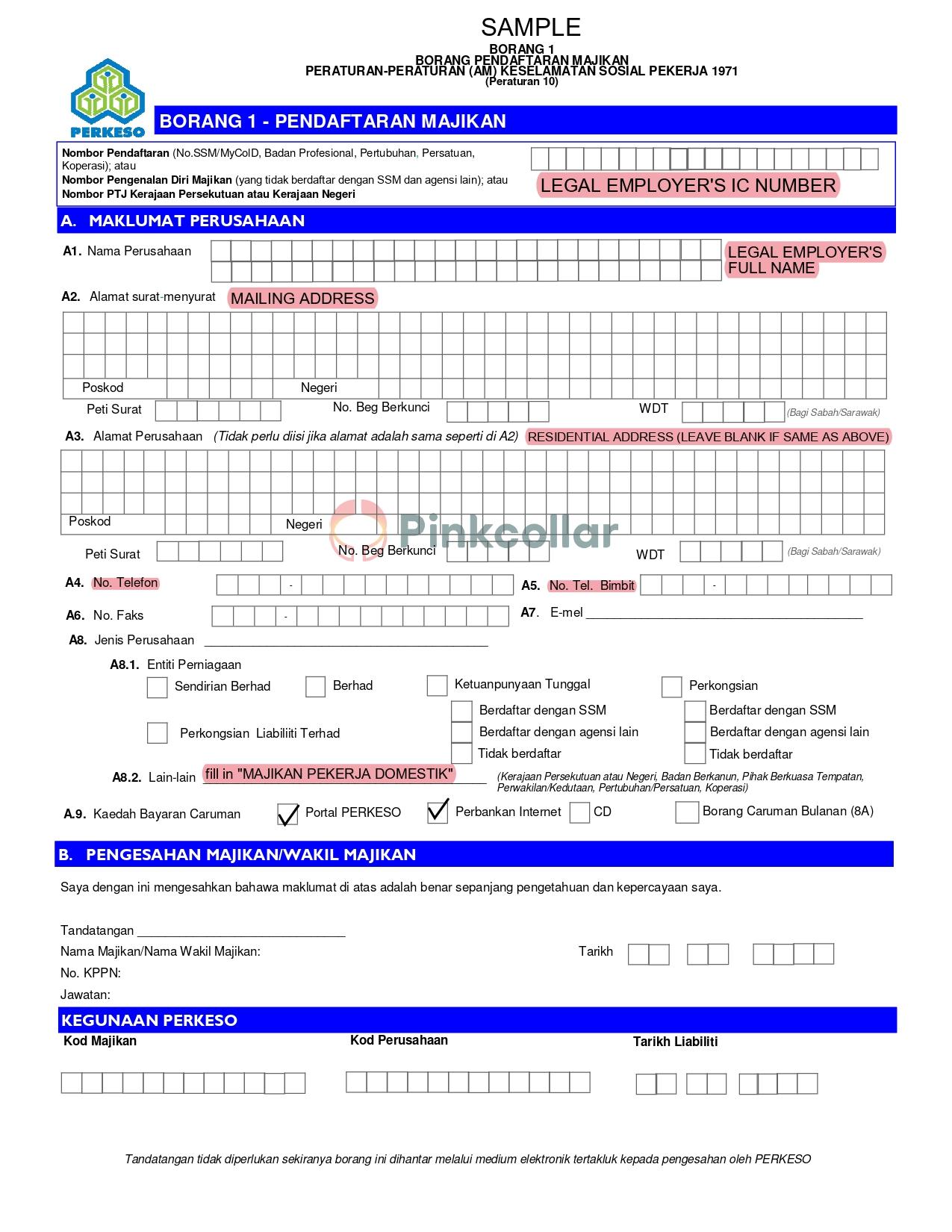

Sample 2: Borang Pendaftaran Majikan (Borang 1) / Employer Registration Form (download)

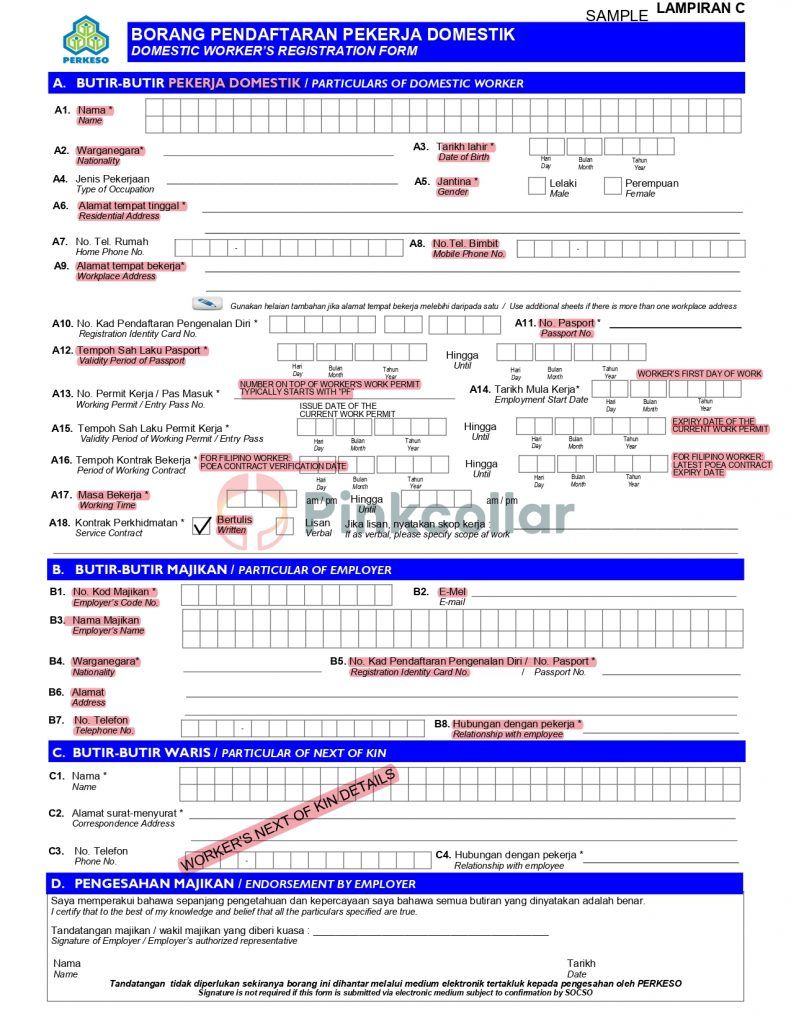

Sample 3: Borang Pendaftaran Pekerja Domestik (Lampiran C) / Domestic Worker’s Registration Form (download)

Sample 4: Borang Pengisytiharan Orang Tanggungan Pekerja Asing / Domestic Worker’s Beneficiaries Form (download)

Part 3 - Email SOCSO to kickstart the ASSIST Portal Registration Process

- Email a filled in Borang Pendaftaran ID Portal PERKESO / Portal ID Registration Form as an attachment to idportal@perkeso.gov.my to receive your User ID via email within 3 working days.

- After 1 to 3 working days, you will be notified of your new ASSIST portal log-in credentials (and temporary password) via email. First-time users will be prompted to set up a new password upon logging in with their User ID.

Part 4 - Login to the ASSIST Portal with your ID to Key in Employer and Worker Information

- Once you receive the email from assist@perkeso.gov.my, log in to SOCSO's ASSIST portal using your new User ID and temporary password.

- The portal will direct you to reset a new password and security question. Once that is done, you will be directed to a page with your basic information autofilled.

- Proceed to the next page by clicking on the "SAVE & CONTINUE" button and the "DONE" button in the next page.

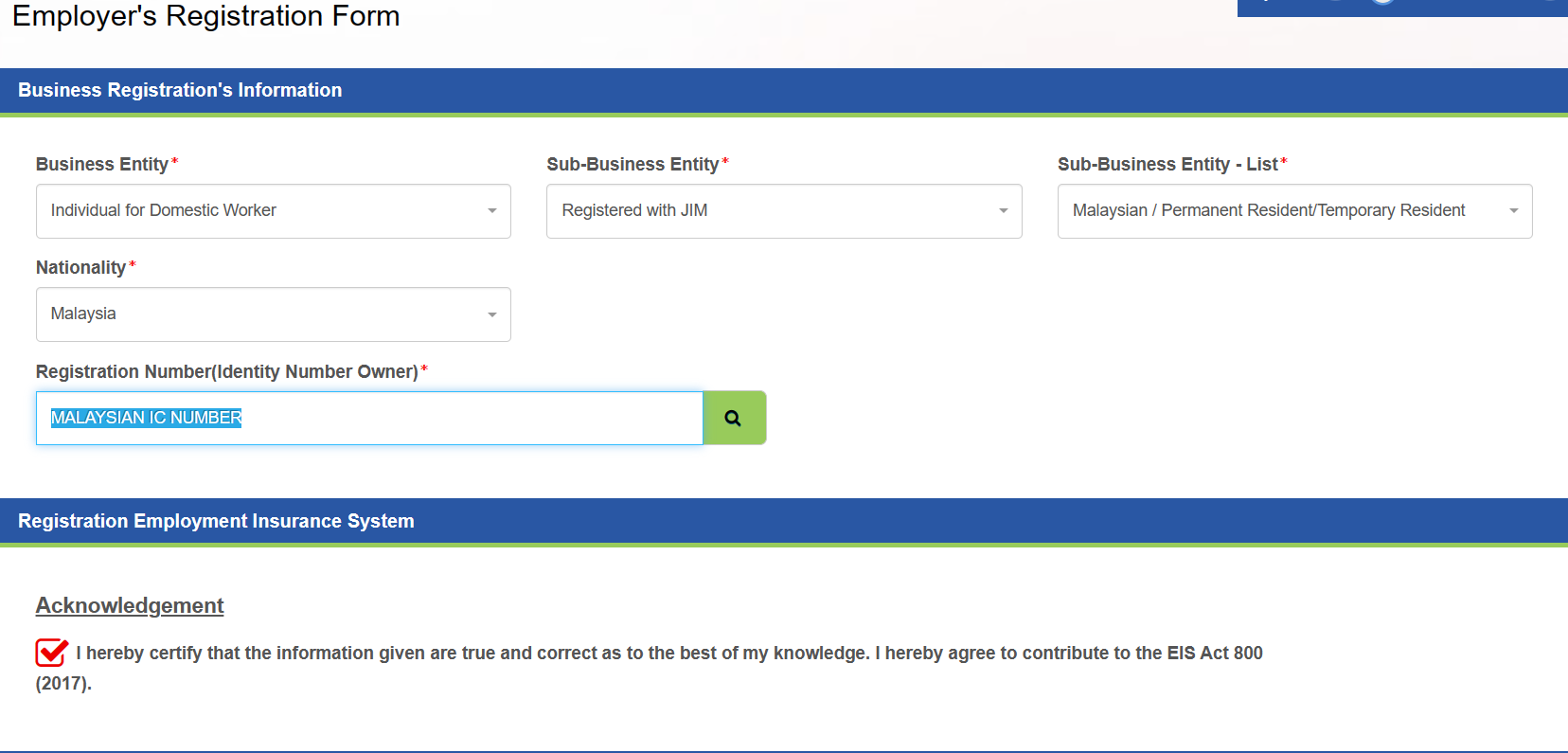

- Next, you will be required to key in your information to the ASSIST portal, following your Borang Pendaftaran Majikan (Borang 1) / Employer Registration Form.

- To do this, click on "My Sites" on the top right corner of the website, and select "REGISTRATION". You will find yourself at the Registration page (screenshotted below) after clicking on the "Registration" and "Employer Information" tab. Fill in your information here.

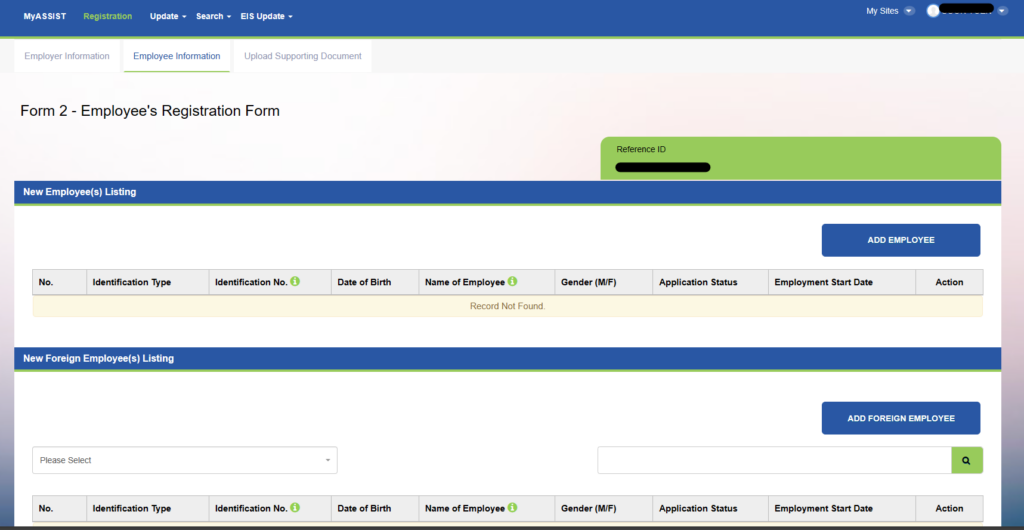

- After clicking “SAVE & CONTINUE” when you have completed filing in Employer’s information, you will be brought to the “Employee Information” tab to register your worker (screenshotted below). Be sure to click on “ADD FOREIGN EMPLOYEE” button to proceed.

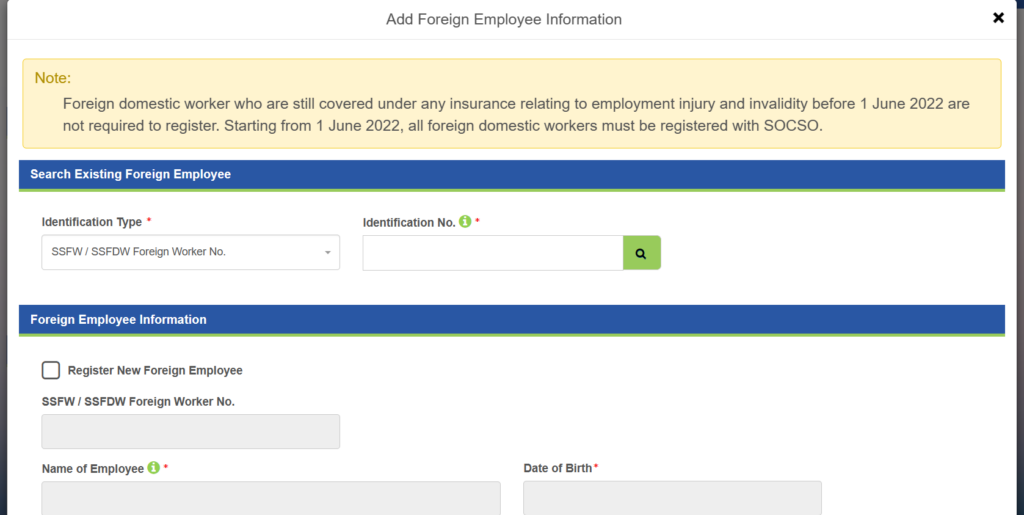

- If your worker has never been registered on SOCSO before, continue by checking the box "Register New Foreign Employee" and fill in the fields following the Borang Pendaftaran Pekerja Domestik (Lampiran C) Form. If your worker was previously registered on SOCSO under another employer, search for her records in the first section (screenshotted below).

- After saving your worker's information, you are required to upload all the supporting documents and filled in soft-copy forms. You must also download the "SIP 1" and "Borang Pendaftaran DS" documents provided to you and re-upload them as supporting documents.

Part 5 - Complete your SOCSO Registration by Uploading the Remaining Forms and Supporting Documents

- Borang SIP 1 (provided)

- Borang Pendaftaran DS (provided)

- Employer Registration Form (Borang Pendaftaran Majikan (Borang 1)

- Domestic Worker’s Registration Form (Borang Pendaftaran Pekerja Domestik (Lampiran C)

- Worker’s Beneficiaries Form (Borang Pengisytiharan Orang Tanggungan Pekerja Asing)

- Copy of Identity Card (Employer’s IC copy)

- Worker’s Passport copy

- Worker’s Work Permit copy (optional)*

*You may not have your domestic helper's latest/ valid work permit yet at the SOCSO Registration stage, especially if your worker has just arrived in Malaysia recently. If this is the case for you, employers should still proceed with the SOCSO registration & contribution process to avoid any late contribution penalties charged by SOCSO, and only fill in your helper's work permit details on the portal at a later time.

- Once you have successfully uploaded the documents, proceed to save your hard work!

- After successful upload, official registration letters will be generated for you on the portal, and copies of these letters will also be automatically emailed to you.

Part 6 (Final Step) - Make SOCSO Contribution Payments

Now that you have successfully registered onto SOCSO as an employer and for your domestic helper, you can now start contributing to your helper's SOCSO by following these steps:

- After logging in, you will be taken to the home page of the ASSIST portal.

- On the right side of the page, click on "My Sites", and then click on "SOCSO - Contribution".

- Hover over the "Employer Contribution" link located on the left side of the page on the ASSIST portal's main navigation bar.

- Click on "Add Contribution (Portal)".

- Click on the "Arrears Contribution" button under the Employer Contribution Pending List.

- Under Submission Contribution Information, select the desired Contribution Month using the dropdown box (it should be the previous month).

- Click "Select", then scroll down until your helper's name is shown under the Employee Contributions section.

- Then click on the edit button under the "Action" column; the amount under the salary column can now be edited.

- Insert your helper's base salary per month under the "Salary (RM)" column, and click "Save Draft".

- SOCSO will help calculate the amount that should be contributed based on the salary/ figure given; click "Complete" to proceed with payment.

- Follow the remaining instructions shown on the website, and you should receive a payment receipt sent to your account's registered email address once the contribution amount has been paid.

Contribution payments for the current month can only be paid after the 16th day of every month; e.g. if an account was registered on the 1st of January, contributions can only be made after the 16th of January.

Need assistance in registering SOCSO?

If you encounter any issues doing this yourself, contact SOCSO directly at 1-300-22-8000 or visit SOCSO's website for further assistance.

Pinkcollar can handle the SOCSO employer registration process for you end-to-end. Engage our SOCSO Registration service to gain access to your account without hassle and start your contributions promptly.